AMD's New AI Chip and the Semiconductor Rush

Hello Everyone,

AI news is one thing, but I am going deep down the Semiconductor News rabbit hole. For context, Nvidia shares hit an all-time high as the chipmaker continues to ride a massive wave of demand for its artificial intelligence chips. It's now valued at $3.4 Billion. AMD is a potential competitor in AI chips, and they are both major customers of TSMC.

Chipmaker Nvidia notched $30 billion in revenue last fiscal quarter, driven in large part by the AI industry’s insatiable demand for GPUs. I'm fairly bullish on AMD's prospects and their new AI chip, even though Walstreet thinks the company is already a bit over valued.

Who at AMD thought announcing their AI chip on the same day as Tesla's robotaxi event was a good idea back on October 10th, 2024? The Instinct MI325X’s rollout will pit it against Nvidia’s upcoming Blackwell chips. Nvidia is obviously the best in class but demand for Blackwell is so high they cannot keep up.

With the relative decline of Intel, and struggles at Samsung, companies like TSMC and AMD have a huge opportunity. If AMD can establish itself as the second best player for AI chips, it will have a great future.

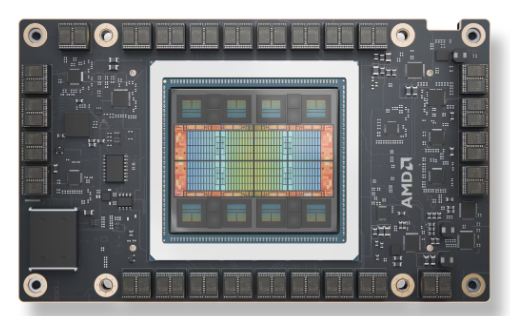

The AMD Instinct MI325X is a cutting-edge GPU accelerator designed to set new standards in AI performance. Featuring up to 288GB of HBM3E memory and a bandwidth of 6.0TB/s, it offers exceptional efficiency for both training and inference tasks. Built on the CDNA 3 architecture, the MI325X delivers up to 2.61 PFLOPs of peak eight-bit precision performance, making it a formidable competitor to Nvidia's offerings.

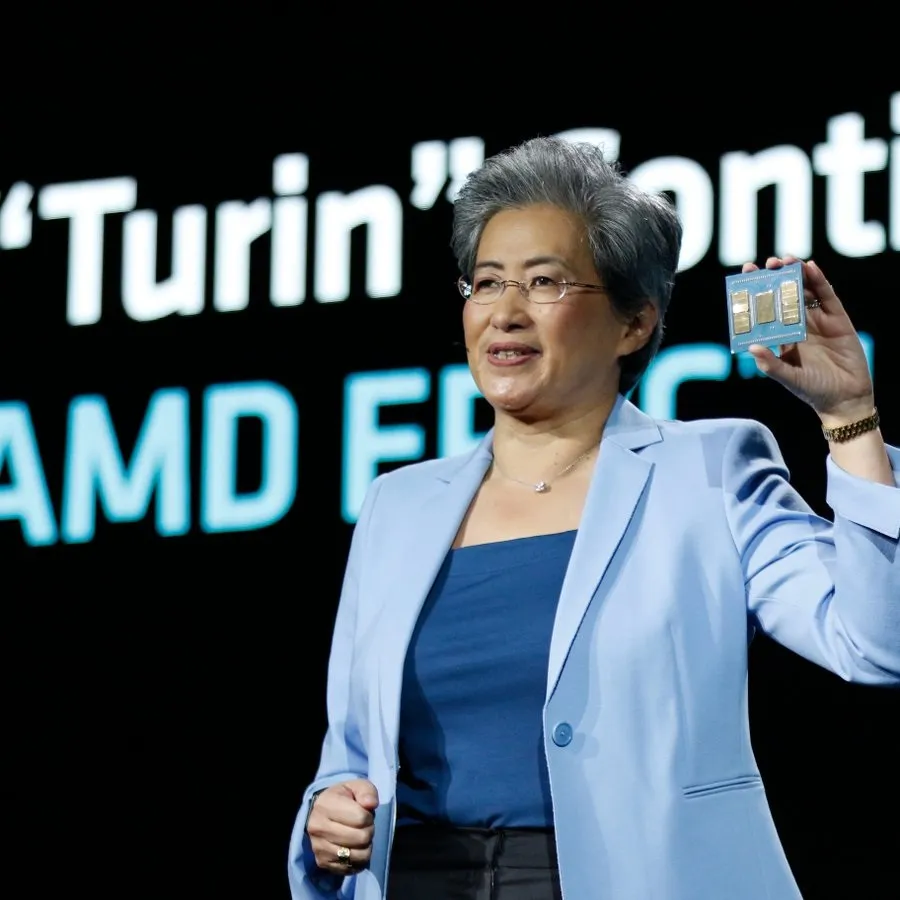

AMD officially announced the MI325X on October 10, 2024, during an event focused on AI infrastructure solutions. You can see the abbreviated version via CNET here. I actually think the AMD CEO Lisa Su is very talented, smart and motivated now with Nvidia's tremendous success of the last couple of years.

So while the likes of Huawei’s attempts to fill the Nvidia-sized gap in China’s AI market are being hindered by performance issues and slower connectivity speeds with its hardware alternative, AMD has a very unique opportunity if it can fill the void.

The U.S. in this era of U.S. exceptionalism in AI, plans to control the flow, quite literally. They will increasingly cap exports, all that free market capitalism wasn't supposed to be. Already, the Biden administration has restricted AI chip shipments by companies like Nvidia and AMD to more than 40 countries across the Middle East, Africa and Asia over fears their products could be diverted to China. A lot of people don't even realize this is happening.

As if the world didn't have enough monopolies, gatekeepers and artificial moats. The new approach would set a ceiling on export licenses for certain countries in the interest of national security. While China has a nearly insurmountable crisis of its foundations, a lot is being done in the U.S. based on these supposed National security concerns.

Ironically both Nvidia and AMD's CEOs are Taiwanese-Americans. BigTech is fueling all of this demand. Companies including Microsoft, Meta, Google, Amazon, Tesla, xAI and Oracle are purchasing Nvidia’s graphics processing units in massive quantities to build large clusters of computers for AI. There's no way they can keep up with the demand, AMD is likely the next best bet.

U.S. baking in A.I. Supremacy into their Rule of Law

Now U.S. policy would build on a new framework to ease the licensing process for AI chip shipments to data centers in places like the United Arab Emirates and Saudi Arabia. Commerce Department officials unveiled those regulations last month and said there are more rules coming.

Meanwhile BigTech is carving up the planet for new datacenter territory. TSMC's, Taiwan Semiconductor Manufacturing Company said recently that sales figures for June that showed revenue rose 33% from a year earlier. TSMC is set to report a net profit of T$298.2 billion ($9.27 billion) for the quarter ended Sept. 30, according to a LSEG SmartEstimate drawn from 22 analysts. That's probably more like 40%.

The launch of the MI325X is part of AMD's broader strategy to challenge Nvidia's dominance in the AI hardware sector, where Nvidia currently holds a substantial market share. The U.S. will use access to AI chips as a bargaining chip geopolitically and diplomatically apparently in a similar way as to how China has operated globally for years.

AI chipmaker Cerebras is trying to be the first major venture-backed tech company to go public in the U.S. since Rubrik’s IPO in April. I'm tracking about half a dozen companies in the U.S. and another half a dozen in China, but they have a long ways to go to become actual competitors of Nvidia. Nvidia's GPUs originally for gaming and crypto, are now the spice of the most golden fruit Capitalism has to offer.

Huawei's Ascend 910C chip while being used by several Chinese companies by national mandate, doesn't seem to be on par with Nvidia's products, even its lesser ones. Huawei has promoted its Ascend AI chips as a potential alternative to Nvidia's hardware, as the U.S. company is prohibited from exporting its GPUs to China under export controls by the Biden administration. Geopolitics is a huge part now of how AI chips and the semiconductor industry will evolve.

The U.S. is trying to put China at a major disadvantage, already rumored to be between five to ten years behind. U.S. regulators in 2022 had slapped restrictions on Nvidia to stop the firm from selling AI chips, including the H100, in China, citing national security concerns. What this has done is made China more aggressive in its timeline to become a major player in datacenters, AI chips and the semiconductor industry.

AMD to reportedly become TSMC's next major customer in Arizona — HPC AI chips could start US production in 2025

As you likely already guessed, The MI325X is built on AMD's CDNA3 architecture and utilizes advanced manufacturing processes from TSMC. The U.S. is working with Taiwan companies in a way that boosts the entire country economically even as China has entered one of the worst slumps in recent memory. Some pundits believe China is preparing to invade Taiwan by force potentially in the 2027 to 2032 window.

AMD is set to produce high-performance chips at TSMC’s new Arizona fab, making it the second high-profile client for the fab after Apple. Independent journalist Tim Culpan reports that sources close to the matter confirmed the agreement recently.

AMD's stock is up 55% compared to a year ago, but nothing like the wild moves of Nvidia's valuation. AMD's valuation today is already at a wild P/E ratio of nearly 197. Technically Nvidia's success has spilled over to other related names as its revenue surged on these huge orders mostly by the major Cloud players in the U.S.

AMD primarily known for designing and manufacturing microprocessors, graphics processors, and related technologies for both consumer and enterprise markets was founded in 1969. AMD is recognized for its innovative CPU designs, particularly the Ryzen series, which has gained significant market share against its main competitor, Intel. But can it become known for AI chips as well?

Nvidia, widely viewed as the company selling the picks and shovels for the AI gold rush, has been by far the biggest beneficiary of the generative AI boom, but I believe AMD can be second best.

As of 2023, the AI chip market was valued at approximately $53.7 billion and is projected to grow by over 30% in 2024, reaching around $71 billion. Given how BigTech is fueling greater demand in datacenter expansions and significant capex spending on AI, Nvidia's monopoly on AI chips is a massive moat.

Today AMD has a market cap valuation of $271.73 Billion. Lisa Su is a step above the average CEO in her industry. AMD's AI strategy makes a lot of sense to me, and how they are working with TSMC on American soil is full of intrigue for a tech watcher like me.

Nvidia literally controls about 95% of the market for AI training and inference chips, according to analysts at Mizuho. AMD has the best chance of taking a slice of this growing market. The Instinct MI325X, as the chip is called, will start production before the end of 2024, Advanced Micro Devices said Thursday during an event announcing the new product.

Big winners of this era to me include Nvidia, but also TSMC, Broadcom, ARM and maybe even AMD. SoftBank's Arm is gearing up to enter the AI chip market, with plans to launch its own AI chips by next year. Sam Altman is nothing compared to Taiwan's influence on the semiconductor industry. But if OpenAI succeeds, they will also fuel even more demand for AI chips and their evolution.